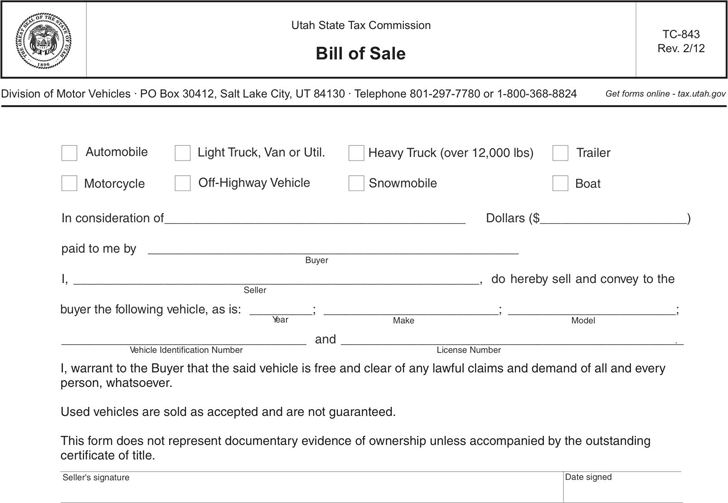

utah state tax commission bill of sale

As required by Utah law the date time location and description of. The Utah State Tax Commission is the primary tax collecting agency for the state of Utah.

Tc 40e Fill Out Sign Online Dochub

They are responsible for administering and enforcing the states tax laws including.

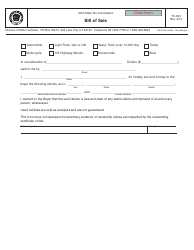

. Utah StateTax Commission TC-843 Bill of Sale Rev706 Motorcycle Automobile Light Truck Van or Util. The Utah Vehicle bill of sale form needs to be filled in situations when a transaction buying or selling of a vehicle is in process to be completed. 51 rows Current Utah State Tax Commission motor vehicle forms and.

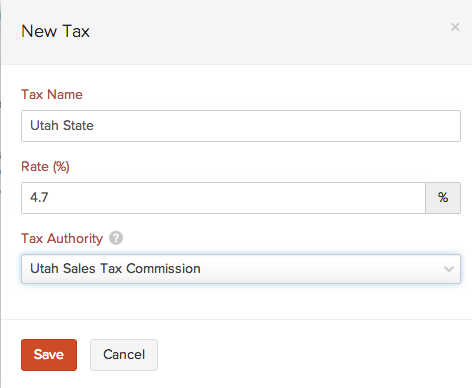

You can apply for a license online at taputahgov Tax Commission only or. 51 rows Utah Sales Tax Refund Booklet for Religious or Charitable Organizations. Every seller with an established presence in Utah see Nexus Filers below must have a Utah Sales Tax License.

For the buyer the bill of sale. It is important to write up a bill of sale when selling an automobile. For the seller a bill of sale provides proof that title to the vehicle has been legally transferred.

The Utah State Tax Commission may sell any impounded vehicle that is not recovered by the legal owner within 30 days of the date of seizure See Utah Tax Code 41-1a-1103. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. However the Utah State Tax Commission provides a bill of sale form for your use.

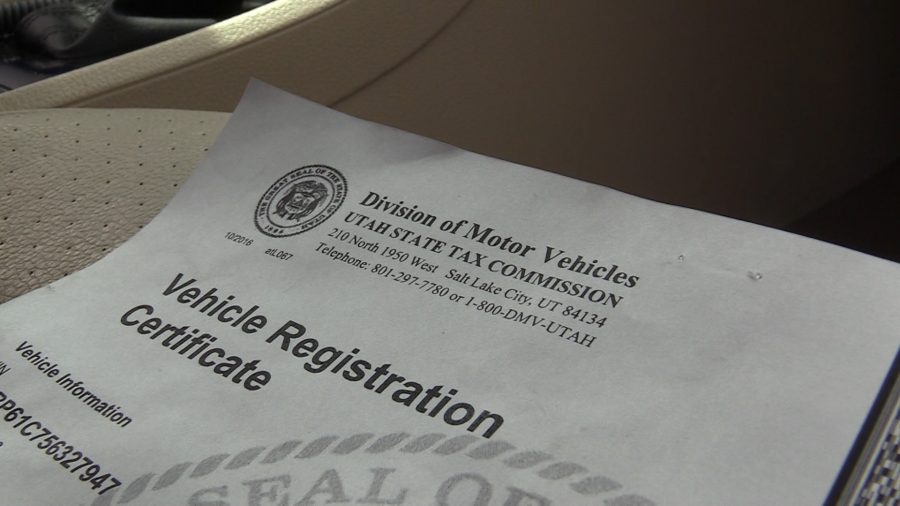

Please contact us at 801-297-7780 or dmvutahgov for more information. TAP Online System. Businesses should contact a business attorney or visit the Utah State Tax Commissions website to learn more about the rules regulations tax laws and tax information associated with their.

Utah State Tax Commission Subject. Personal Property Bill of Sale. Utahs Bill of Sale Requirements.

Property tax forms publications and instructions. Utah citizens selling a vehicle in a private party transaction must fill out and sign a Bill of Sale Form TC-843 stating the buyer now owns the vehicle free and. Tax rates are also available online at Utah Sales Use Tax Rates or you can.

The official site of the Division of Motor Vehicles DMV for the State of Utah a division of the Utah State Tax Commission. 212 Division of Motor Vehicles PO Box 30412 Salt Lake City UT 84130 Telephone 801-297-7780 or 1-800-368-8824 Get forms online - taxutahgov Utah State Tax. These sales are performed by way of public auction at the impound yard where the vehicle is located.

Heavy Truck over 12000 lbs Trailer Off-Highway Vehicle Snowmobile Boat. PT-117 Personal Property Bill of Sale Author. Bill of Sale Rev.

It is primarily used as a personal record. The Utah bill of sale forms allow for the transfer of a vehicle vessel firearm heavy truck over 12000 lb motorcycle trailer snowmobile or any off-highway vehicle from one party to. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

A Utah bill of sale is not required to register a motor vehicle. Visit Utahgov opens in new window. Personal Property Bill of Sale UCA 59-2-1303 Form PT-117 PT-117ai Rev.

New Utah Law Says Drivers No Longer Need Proof Of Registration In Their Vehicle

Form Tc 843 Download Fillable Pdf Or Fill Online Bill Of Sale Automobile Trailer Boat Utah Templateroller

How To Get A Replacement Title For Your Scooter Youtube

Form Tc 62n Fillable Utah Sales Tax Refund Booklet For Religious Or Charitable Organizations

A Toast To Utah Liquor Dollars They Topped A Half Billion For First Time

Utah 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Tracking 2022 Utah Legislative Bills

Kansas State Sales Tax Tokens Hobbylark

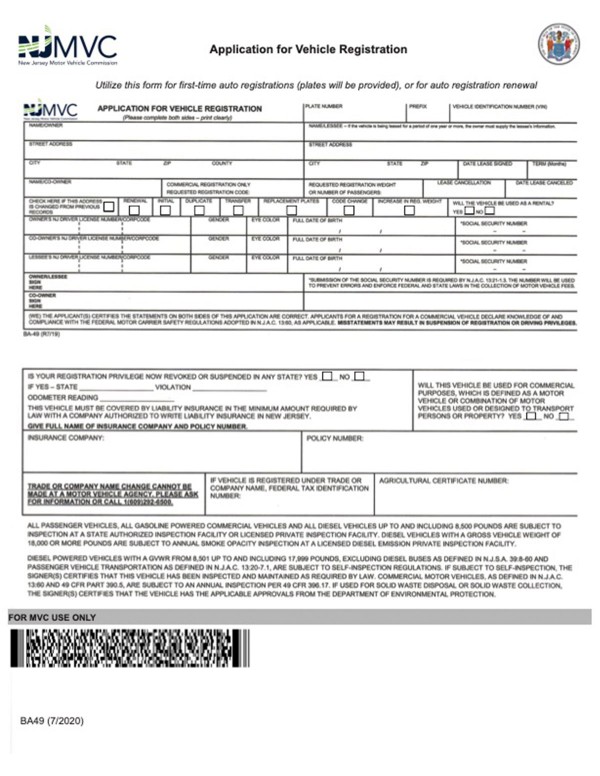

All About Bills Of Sale In New Jersey The Forms Facts You Need

Utah State Tax Commission Notice Of Change Sample 1

.jpg.aspx?lang=en-US&width=500&height=197)

Multistate Tax Commission Uniformity

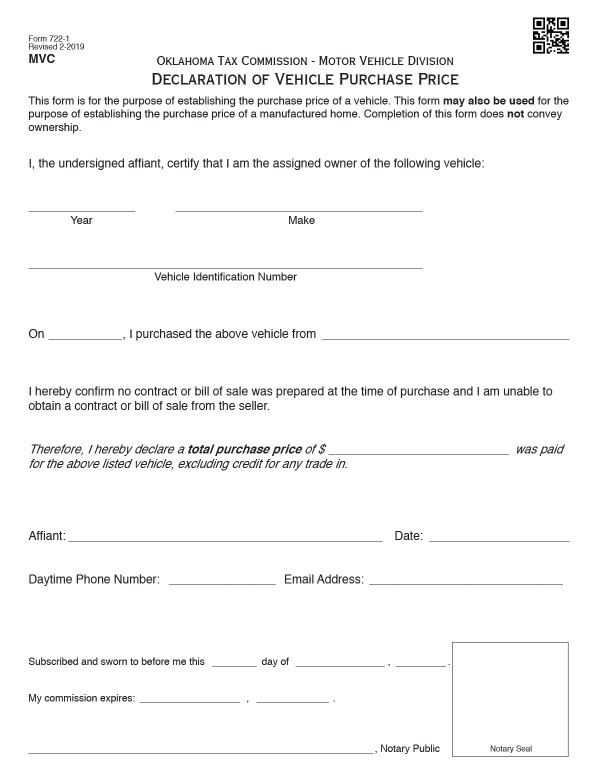

Bills Of Sale In Oklahoma The Templates Facts You Need

Free Utah Motor Vehicle Bill Of Sale Form Pdf 102kb 1 Page S

15 Free Utah Bill Of Sale Templates Pdf Doc Template Republic